How to Vanguard

This is a Q&A about investing, with step-by-step instructions for contributing to (and automating) a Vanguard target retirement fund.

What are great ways to start investing with stock when you're a beginner?

The Robinhood app isn’t great to use as a retirement account, but it is good for buying a share or two of a company’s stock to keep track and see what it’s like to follow a company. If you opened a Robinhood account and bought one share of a low-ish priced company, it’s fun to track. The good thing about Robinhood is that you don’t pay a commission when you make a stock purchase, whereas a lot of other brokerage companies do. This is an exercise in learning about the stock market. I don’t have more than 1-5% of my investments in individual companies. It’s okay to have a small percentage if you enjoy it; it’s just not recommended to take on such a risk with a larger percentage of your overall investments.

What are some basics I must know while managing/looking to buy or sell stocks and bonds?

The basics are that anyone who thinks he/she can try and make money by buying and selling stock, picking the exact companies that will go up in stock price, and sell the companies right before they go down in price, is...misguided at best. The stock market is impossible to predict on a short term basis.

The best strategy is to buy the entire market, and never sell (until retirement, that is). Buying the entire U.S. stock market, for example, is not a risk compared to buying a handful of companies. The U.S. economy, innovation, technology, and market will go up over time - and experience occasional tough down times - but companies on an individual basis all have an expiration date. Investing in the entire market over a long time (decades) is extremely likely to be fruitful. Trying to pick individual winners and losers is ultimately a loser’s game, and not much better than gambling.

The research on this is as solid as the research that says smoking is bad for you. Even the professional investors and money managers can’t beat, for example, the S&P 500 (the largest 500 companies in the U.S.) over 5, 10, 30 year time periods. Some can do it for a year or a few years, but the reason is often luck (someone is statistically likely to do it, and that someone is extremely unlikely to be you or me). It seems counterintuitive, but the people who do the best investing in the stock market are those who are super diversified (buying the whole market), automate the buying (auto-contributions every month, for example), and ignore what’s going on with the market.

What’s more, owning the entire stock market ensures that you get the benefits of the winners, without knowing who those winners will be in advance. General Electric used to be one of the largest companies in the world based on share price. Car companies like Ford and General Motors were the big winners at one point too. Now they’re well out of the top ten. You and I don’t know what the next Microsoft, Apple, Amazon, or Google will be. But whichever company (which might not even exist yet!) is a big winner in the future, you’ll own it with a simple index fund that holds the stock market in proportion to size (i.e., the largest companies will make up a larger proportion of the index fund’s holdings).

Where do I go to manage stock and bonds?

Vanguard: it has low fees (which is a huge deal), and the individual account holders ‘own’ the funds. I highly recommend a Roth IRA. You can contribute $6,000 per year to an IRA as of 2020.

Open a new account at Vanguard, link it to your bank account, and you can start contributing.

Other good custodians: Charles Schwab, Fidelity (many 401ks are administered by Fidelity - you might even have an account). Betterment is a good one that is more customized to what you want and uses behavioral science-backed techniques to keep you on track.

Once you have an account, the tough part is figuring out which funds to put money into. There are thousands of funds overall, and hundreds just within Vanguard. The nice thing is that you only need one. Vanguard target retirement funds give you access to the entire U.S. and global stock market at a super low fee, and the fund changes automatically over time to be less risky so that you don’t need to worry about a huge market downturn 30 years from now. The fund starts with a high percentage in stocks (more risk) and a low percentage in bonds (very low risk), and that percentage gradually goes down for stocks and up for bonds over time. You can automate contributions and never need to think about it. And you’ll get better performance over time than the ‘pros.’

This all-in-one, set-it-and-forget-it fund that I would pick if starting today for someone who has ~30 years until retirement is the Target Retirement 2065 Fund (VLXVX is the ticker symbol, i.e., the shorthand code name). I pick 2065 because it has a higher percentage in stocks (90%) than earlier retirement date funds, not because I’m thinking of retiring in 2065. Step-by-step instructions below for how to buy VLXVX. (See more on target date funds here. Ticker symbols for other years are included at the very end of this document.)

How do I organize and keep track of my financial portfolio at home?

Once you have your Vanguard account (click here), it will be your one-stop shop.

What must I have set up for a stable retirement? And what are a couple monthly routines to do to make it successful?

Honestly, you just need the savings, and a savings habit. The VLXVX fund takes care of the risk part, since it becomes less risky over time automatically. The routine to make it successful is to automate it, and maybe check once or twice a year to make sure everything looks okay. The less you look at the account balance, the better. Folks who look all the time tend to make emotional (i.e., bad) decisions like selling things off.

Is there anything I should never do regarding stocks/retirement?

If you get interested in individual companies, it’s not the worst thing to buy shares in some. I own a few, but they’re only a small percentage of my total funds (<5%). This should be considered “fun money” that you’re willing to lose. The thing to never do is sell VLXVX (until retirement). Keep buying into it, no matter what. Don’t sell when markets go down (if anything, buy more when that happens, if you can).

What are some good beginner companies to invest in? How do I know what a smart amount to invest is? What are good indicators of it being a good/bad time to invest?

It’s never a bad time to invest. Even when markets are at all time highs, as has often been the case for the last few years, markets are much more likely to continue to go up - even at all time highs - than they are to go down. I’m not thinking about what markets will do in the next month, or year, or even ten years. I’m investing to have money in 30 years so I can do whatever I want with my time (and if I’m lucky, sooner than that!).

Again, if you want to invest in individual companies, do so in very small dollar amounts (<5% of your Vanguard holdings). Invest in companies you find interesting! That’s the most fun. I only own four individual companies: Amazon, Berkshire Hathaway (I live in Omaha so this was a no-brainer to get into the annual shareholder meeting), Spotify, and Ally Bank (I love this bank and use it for a savings account).

When is a good time to withdraw from investment accounts?

The time to withdraw is when you want to retire. If, as a very very last resort, you need some emergency funds, you can withdraw your contributions (not earnings) to a Roth IRA without penalty (that’s one of the benefits compared to a Traditional IRA). Otherwise, keep buying, never sell, and think of the funds as savings for 30 years from now.

See below for how to put money into the only fund you’ll ever need. It’s super diversified, practically zero cost, and becomes less risky over time.

How to buy a target retirement fund, and (further down) how to automate contributions:

Once you start your Vanguard Roth IRA and get it linked to your bank account (link shared above), you can start contributing. You’ll need $1,000 in the money market fund before you can purchase VLXVX (or other target dates - see the ticker symbols at the end of this document).

To put money into your money market account, go to the “Balances and holdings” page under “My Accounts,” then click on “Contribute/Withdraw,” then “Contribute to IRA” from the dropdown selection (see highlighted images below).

If you don’t have $1,000 yet, you can contribute to the money market fund (essentially your Roth IRA’s checking account balance) any time and keep going until you reach $1,000. Enter the amount you want to contribute (example of $500 shown below), then hit “Continue” under Column 1 (button not shown), make sure the bank account under Column 2 is correct, then click “Continue” (button shown).

If you do have $1,000, you can skip the money market part above and contribute directly to the VLXVX fund (or whichever fund you chose). Check the “Add another Vanguard mutual fund” box, type VLXVX, and select the fund.

The prompts from here might differ a bit depending upon where the money is coming from; if it’s coming from your bank account, choose that from the “Where’s the money coming from?” column. In my case here, the money was in my money market account (settlement fund, shown below). Click “Continue” when ready, then on the next page (not shown) click “Accept,” then on the Review and submit page (not shown) click “Submit.” You did it! You have money in the only fund you’ll ever need.

You can go to “My Accounts” in the top ribbon and select “Balances and holdings” to see your account, and you’ll see VLXVX in your holdings. The current balance will say $0.00, but that’s ok (it might take a couple of days to finalize), notice also the “P” which means the purchase is pending.

The next step is to set up automatic contributions to VLXVX. (You can also contribute manually - there’s a “Buy” button on the screen shot just above right next to the pending balance of $0.00.)

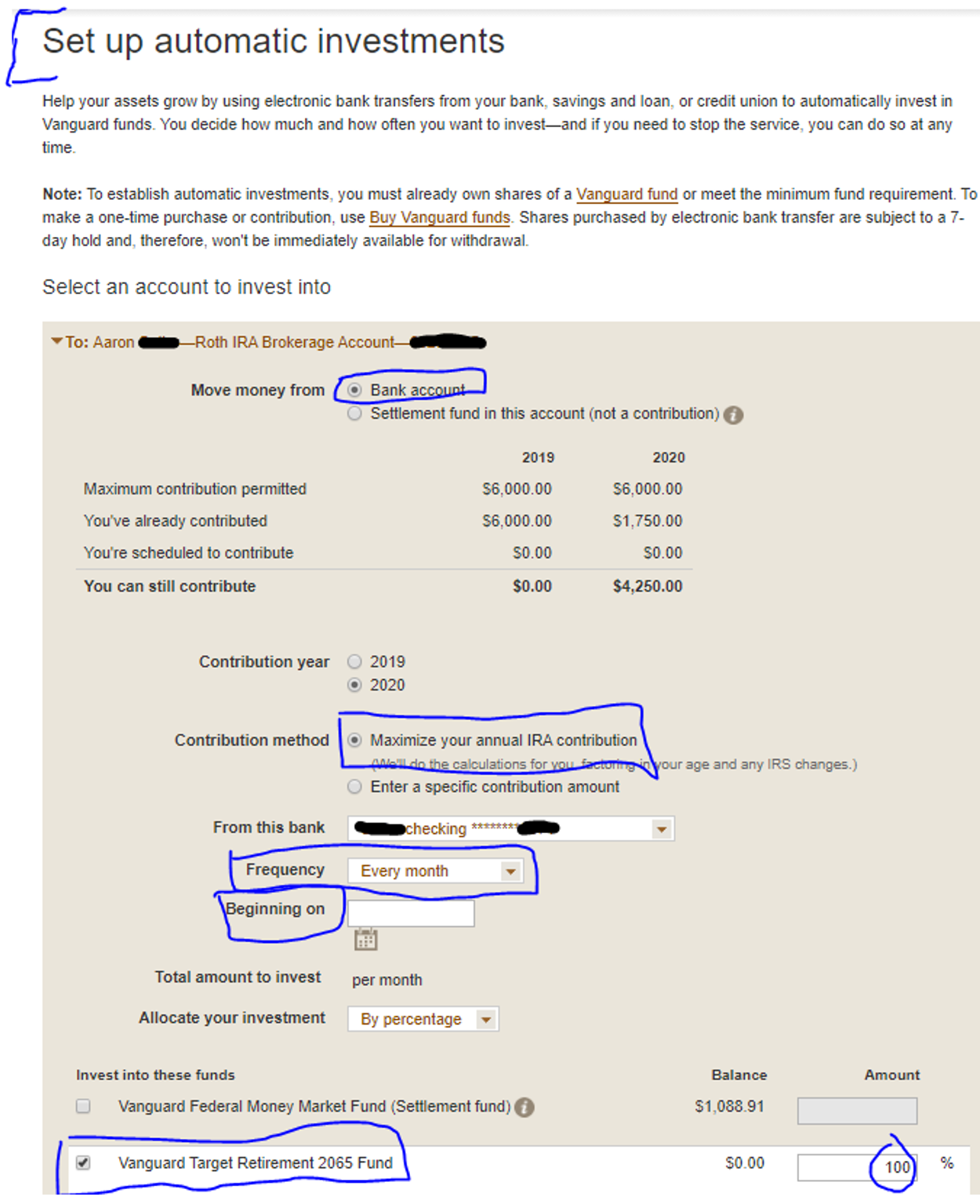

Go here to set up automatic investments: https://personal.vanguard.com/us/AutomaticInvestmentOptionsController

From there, note what’s circled in blue below. I can move money from my bank account every month beginning on a certain date. I recommend “Maximize your annual IRA contribution” - the current maximum is $6,000 per year, but that tends to increase over time. If that’s too much, no problem, you can “Enter a specific contribution amount” under the Contribution method. Invest into your 2065 Fund (or whichever year you chose), as shown below (if you choose a specific amount to invest each month instead, it will look slightly different), then click “Continue.” On the “Review and submit” page that follows, click “Submit.” Nice! You’ve automated your Roth IRA contribution. Of course, you can change this as needed. You’re all set!

Ticker symbols for target retirement funds:

Vanguard Target Retirement 2015 Fund: VTXVX

Vanguard Target Retirement 2020 Fund: VTWNX

Vanguard Target Retirement 2025 Fund: VTTVX

Vanguard Target Retirement 2030 Fund: VTHRX

Vanguard Target Retirement 2035 Fund: VTTHX

Vanguard Target Retirement 2040 Fund: VFORX

Vanguard Target Retirement 2045 Fund: VTIVX

Vanguard Target Retirement 2050 Fund: VFIFX

Vanguard Target Retirement 2055 Fund: VFFVX

Vanguard Target Retirement 2060 Fund: VTTSX

Vanguard Target Retirement 2065 Fund: VLXVX